how to claim california renter's credit

Who can claim the renters tax credit. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if.

California S Stagnant Renter S Tax Credit Could Soon Increase Los Angeles Times

Fill out Nonrefundable Renters Credit Qualification Record available in the California income tax return booklet for your own tax records dont send the form to the.

. How you get it. File your income tax return. Paid rent in California for at least half the year Made 43533 or less single or marriedregistered.

How to claim california renters credit. Part way through 2018 I moved into a room in a. I lived and payed rent in an apartment for all of 2017 and part of 2018.

I was able to claim the Renters Credit on my 2017 return. To claim the renters credit for California all of the following criteria must be met. File a Married Filing Separate or RDP Return Did not live with your SpouseRDP during the last six months of the year Furnish over half of the household.

Your California adjusted gross income AGI is 45448 or less if your filing status is Single or Married Filing Separately or 90896 or less if you are Married Filing Jointly Head of. Check the box Qualified renter. While the rules vary from state to state there are a few things that remain somewhat consistent across state lines.

If you pay rent for your housing have a family with children or help provide money for low-income college students you may. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six. Lacerte will determine the amount of credit based on the tax return.

Fillable Form 1040 2018 Income. You May Be Able to Claim a Renters Tax Credit If You Live in These States Claiming a renters credit on your taxes can help put money back in your pocket Eligibility. California CA offers a credit to renters who fulfill all of these requirements.

Wednesday June 1 2022. Take the amount from California Resident Income Tax Return Form 540 line 35. To estimate your credit amount.

Credits Tax credits help reduce the amount of tax you may owe. Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips. To claim the renters credit for California all of the following criteria must be met.

To claim this credit you must. Go to Screen 53 Other Credits and select California Other Credits.

Property Management License California Laws Requirements

How To File A Renters Insurance Claim In 2022 U S News

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Essential Guide California Film Tax Credits Wrapbook

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22778395/Screen_Shot_2021_08_12_at_11.49.25_AM.png)

The Irs Has A Big Opportunity To Fix The Way Americans File Taxes Vox

How To Add An Eviction To A Tenant S Credit Report

California Rent Relief Program How Renters And Landlords Can Apply Who Qualifies

Average Cost Of Renters Insurance 2022 Valuepenguin

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Renters 7 Tax Deductions Credits You May Qualify For The Official Blog Of Taxslayer

The Best Costco Membership Benefit Is Cheap Car Rentals Reviews By Wirecutter

Ca S Renter Tax Credit Could Increase Up To 1k Cbs8 Com

Renters Credit Would Help Low Wage Workers Seniors And People With Disabilities Afford Housing Center On Budget And Policy Priorities

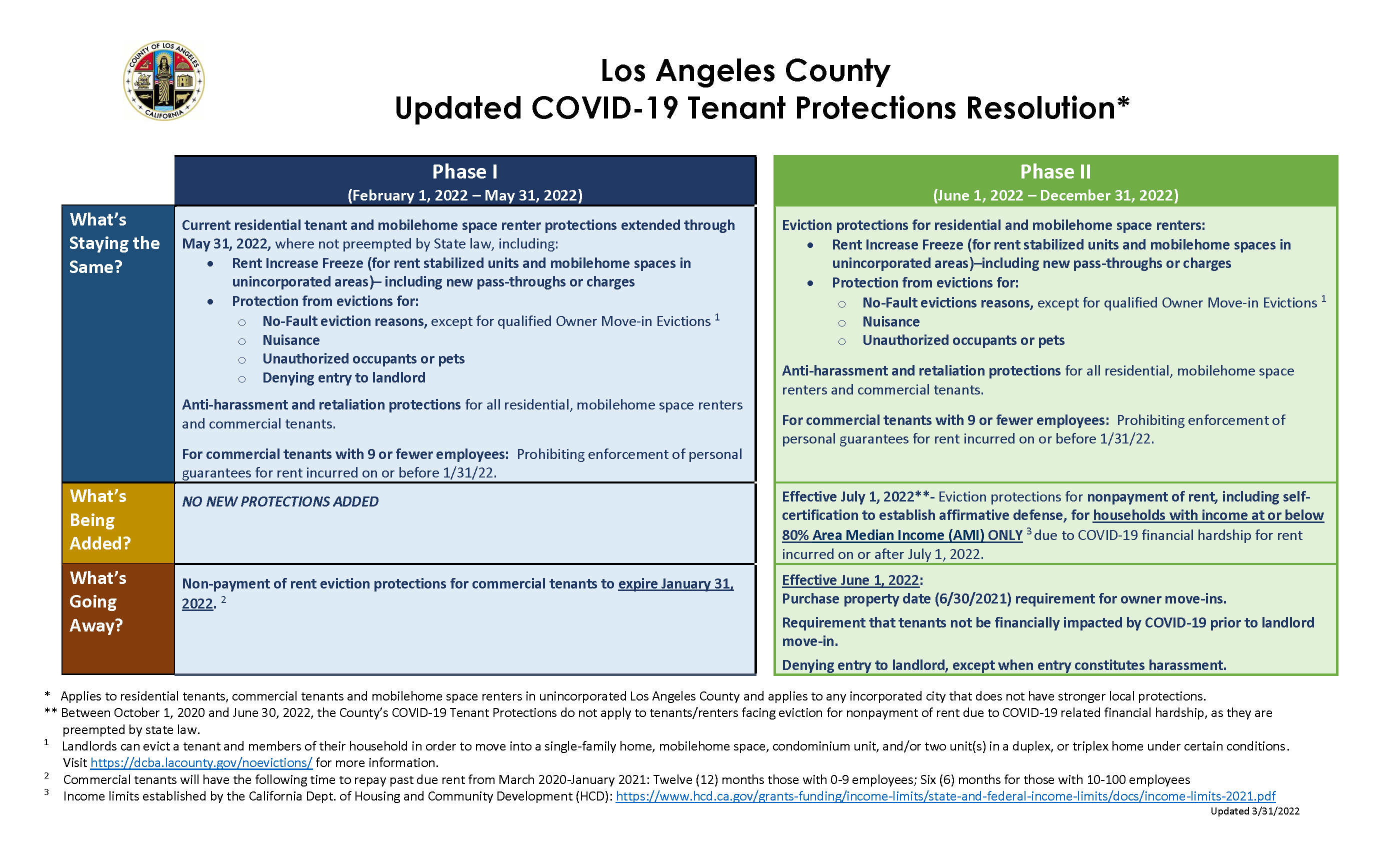

About L A County S Covid 19 Tenant Protections Resolution Consumer Business

Amah Financial Services Facebook

Legal Requirements For Denying A Rental Applicant Adverse Action Letter

Nonrefundable Renter S Credit Rental Housing Programs National Low Income Housing

California Bill Would Boost Renter Tax Credit For First Time In 40 Years Kqed

/what-is-the-employee-retention-credit-and-how-to-get-it-4802575-FINAL-80edb734c86545a5a0b6b54cc0f721ba.png)

The End Of The Employee Retention Credit How Employers Should Proceed