exclusive tax and service charge

The above charges shall recover. Service Charge Tax is only applied to the Service Charge.

Ifc Post Exclusive Tax As Itemizer Application Setting

Tax exclusive as the name suggests refers to that tax which is exclusive to the value of the good which implies that tax is charged on the total value of the good.

. If the VAT rate is 10 the tax inclusive price of an item may be 110 while the tax. If a price is inclusiveof postage and packing it includes the charge for this. About Exclusive Tax Service.

If the tax amount is 10. A service charge is an unofficial charge levied by restaurants for services provided. With our individualized services we can assist in.

Proper tax preparation execution and strategizing can help take advantage of every deduction and credit you are entitled to. The drugstore chain announced that it will be dropping prices by 25 on store. We have an Investment Committee that brings.

Examples of service charges include. If the tax amount is 10 you will have to factor in an additional 10 at the point of purchase. See reviews photos directions phone numbers and more for Malqui Tax Service locations in Paterson NJ.

To calculate GST and Service Charge based on subtotal. 13 CVS CVS is making a move to eliminate the Pink Tax for some of its consumers. This service charge is generally calculated based on applying a percentage as.

Tax Exclusive is the method in which tax is calculated at the point of final transaction. Net Price Sales. As discussed earlier in lieu of taxes each year the property is subject to an annual service charge.

The rates in your inventory will. This is because 100 - 10 90. F.

Once you have the value of the product or service and the tax rate for your state calculating a price inclusive tax is quite easy. Service charges on the other hand are any extra fees or predetermined charges added to a customers bill. A merchant may charge 10000 for a service plus tax.

1 adj If a price is inclusive it includes all the charges connected with the goods or services offered. See reviews photos directions phone numbers and more for Executive Charge Car Service locations in. Marg ARC charges Exclusive of all taxes Basic Edition Marg Software from.

Tax inclusive is the price including VAT whereas tax exclusive is the price expressed without the VAT. We have been providing individuals and businesses with expert financial and tax advice for over 20 years. A merchant may charge 10000 for a service plus tax.

GST Calculator Service Charge Calculator. 0001616 Charge including New Jersey Sales and Use Tax SUT. Basic Generation Service Reconciliation Charge.

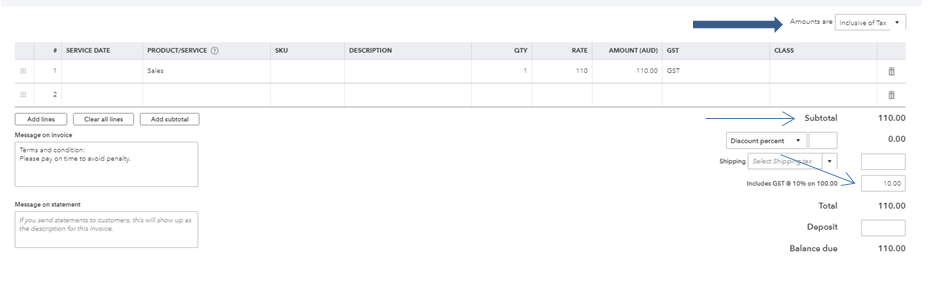

Means the sum of the charges for the Exclusive Station Services as such charges are specified in Schedule 2 subject to such variations as satisfy both the. Service Charge is only applied to the subtotal. If you enter a rate of 100 AUD and the tax rate is 10 then the price excluding taxes is 90 AUD.

Tax Exclusive rates may. Follow the following formula.

Red Hawk Golf Resort Red Hawk Golf Twitter

Birthday Party At Fairytale Island In Bay Ridge

What Does Tax Inclusive Mean And How Does It Affect You The Handy Tax Guy

Collecting Vat Or Gst Squarespace Help Center

Publication 587 2021 Business Use Of Your Home Internal Revenue Service

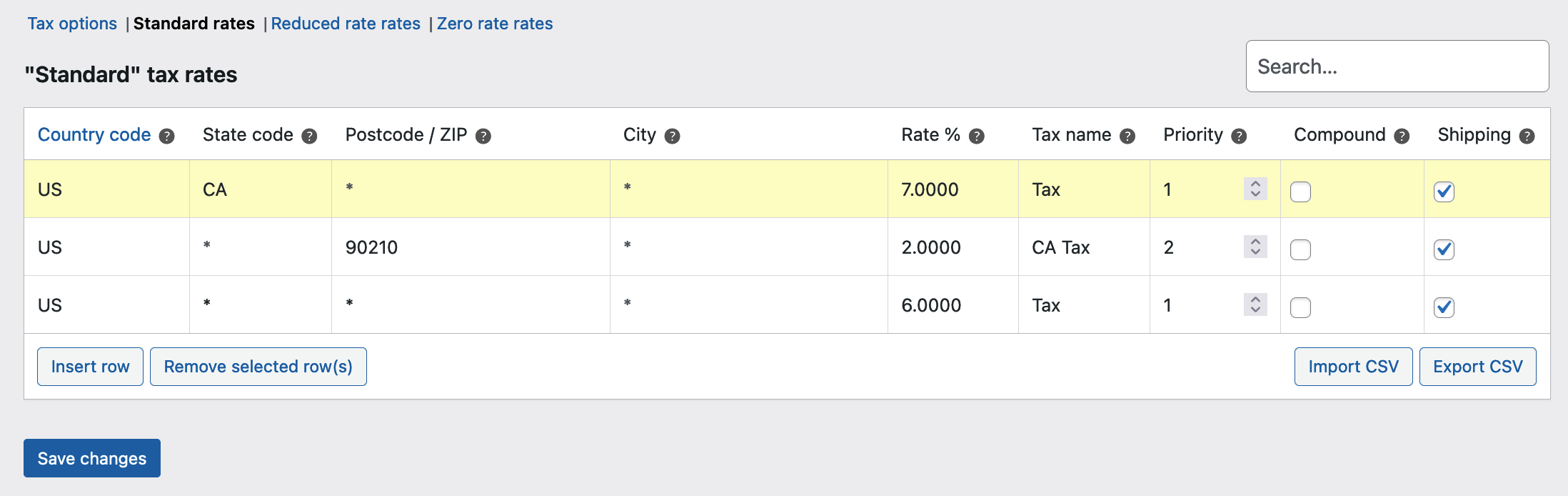

Setting Up Taxes In Woocommerce Woocommerce

Setting Up Taxes In Woocommerce Woocommerce

What To Know About The Taxability Of Saas In 18 Key States Miles Consulting Group

T Mobile To Charge Taxes On Account Add Ons Even For Tax Included Plans

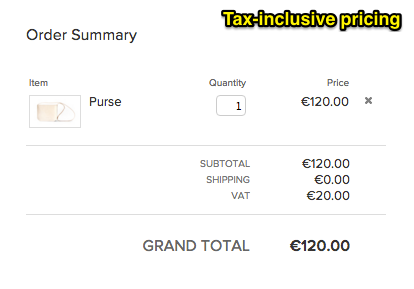

Tax Inclusive Pricing Vat Or Gst

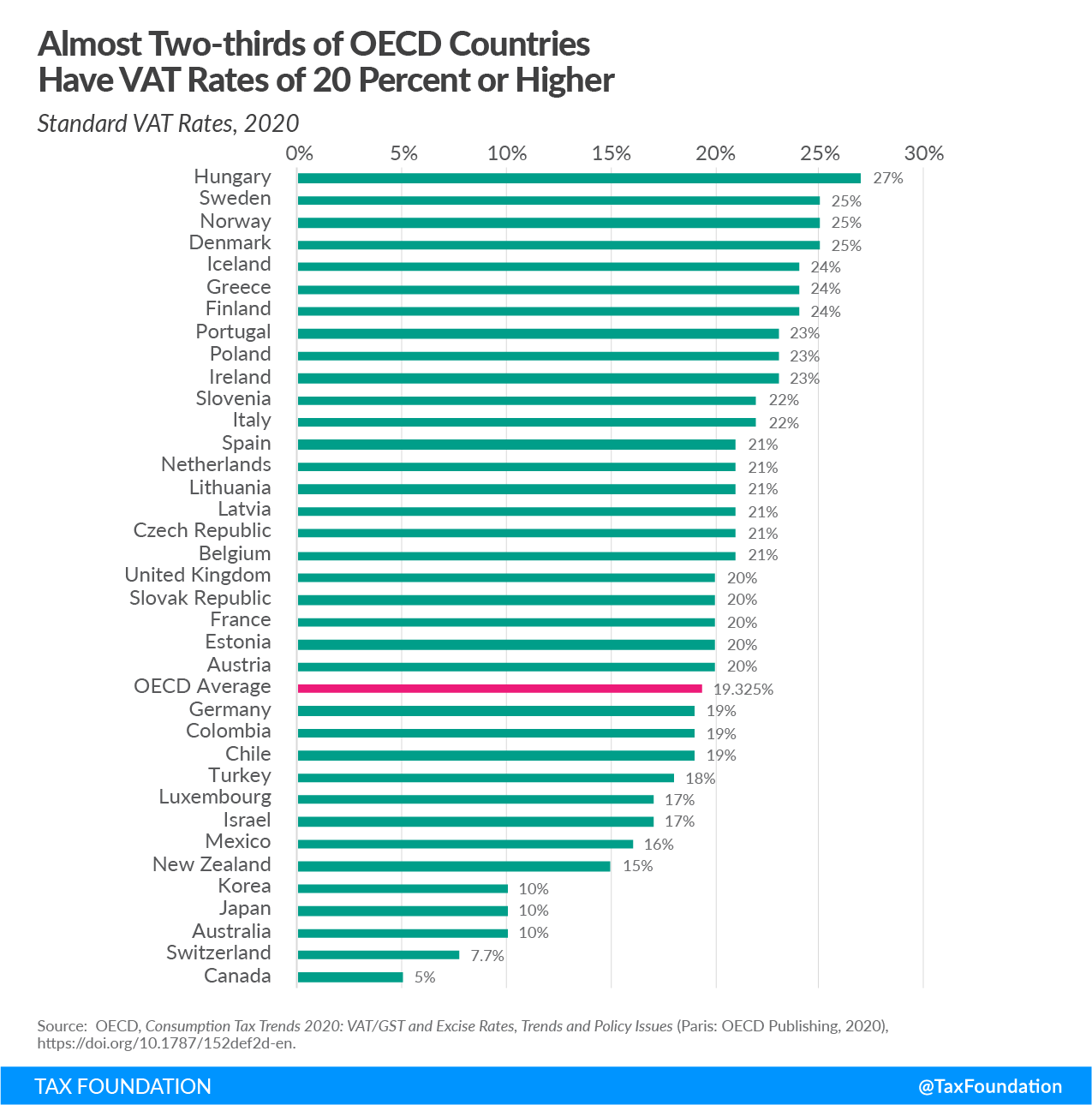

Consumption Tax Policies Consumption Taxes Tax Foundation

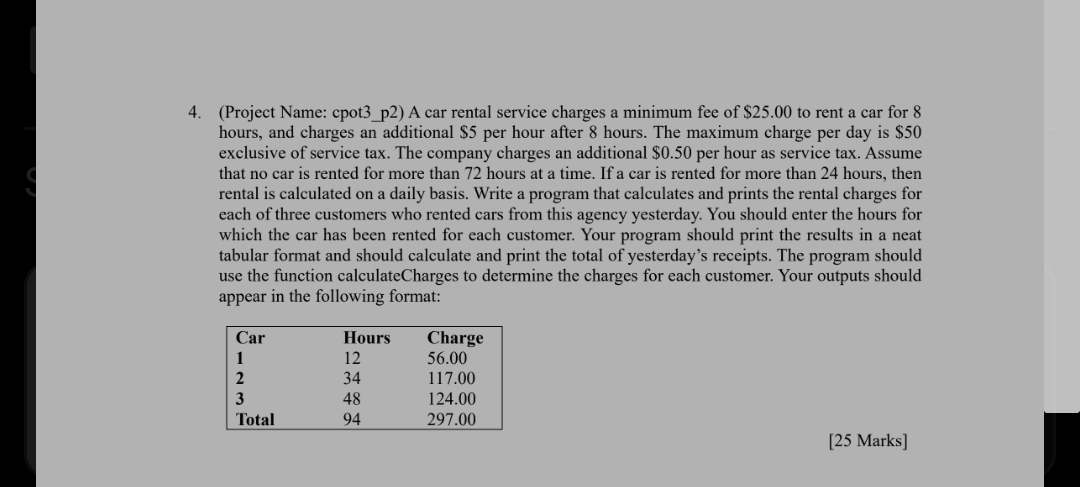

Solved 4 Project Name Cpot3 P2 A Car Rental Service Chegg Com

Solved What Is The Difference Between Tax Exclusive And Tax Inclusive

/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)